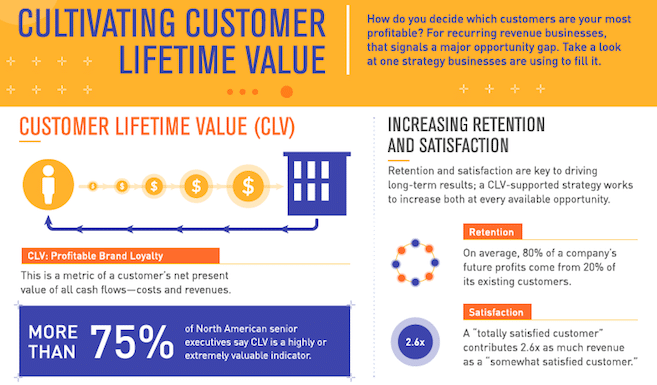

The lifetime value of a customer (CLTV or LTV) is a prediction of the total worth of a customer to a business over the entirety of their relationship. It’s an important metric because it helps a business determine how much they should be willing to spend to acquire new customers and how much they should invest to retain existing ones.

There are several ways to calculate CLTV, and the method you choose will depend on the nature of your business and the data available to you. However, here’s a basic formula that can give you a starting point:

CLTV = (Average Purchase Value x Purchase Frequency) x Average Customer Lifespan

Here’s how to calculate each variable:

- Average Purchase Value: This is the average amount a customer spends each time they make a purchase. You can calculate this by dividing your total revenue in a specific time period (like a year) by the number of purchases in that same period.

- Purchase Frequency: This is how often a customer makes a purchase in a given time period. You can calculate this by dividing the total number of purchases by the number of unique customers in that same period.

- Average Customer Lifespan: This is how long, on average, a customer continues to make purchases from your company. You can calculate this by figuring out the time between a customer’s first purchase and their last purchase, then calculating the average across all customers.

This formula will give you a rough idea of your CLTV, but it’s a very basic calculation. Other, more complex methods may take into account factors like customer segmentation, differing margins and costs, and the discount rate (time value of money).

Remember, the aim of calculating lifetime value of a customer CLTV is to make better business decisions, such as how much you should spend to acquire a new customer (Customer Acquisition Cost or CAC) and how much you should invest in keeping your existing customers happy (Retention).

It’s important to note that CLV is an estimate, and it’s not always accurate. There are a number of factors that can affect CLV, such as customer churn, customer acquisition costs, and product pricing. However, CLV can still be a valuable metric for businesses to track because it can help you make better decisions about how to allocate your resources.

Some tips for improving CLTV

Here are some tips for improving Customer Lifetime Value (CLV):

- Focus on customer retention: The longer a customer stays with your business, the more money they are likely to spend. Focus on providing excellent customer service and building relationships with your customers.

- Upsell and cross-sell: Offer your customers additional products or services that they may be interested in. This can help you increase the average purchase value and frequency.

- Segment your customers: Segment your customers based on their interests, purchase history, and other factors. This will help you target your marketing efforts more effectively and improve your chances of upselling and cross-selling.

- Reward loyal customers: Reward your loyal customers with discounts, free gifts, or other perks. This will help you show your appreciation for their business and encourage them to continue doing business with you.

By following above tips, you can improve CLV and increase the value of your business.